year end tax planning letter

Take a look at our Year-End Tax Planning Letter for some tax-saving suggestions to think about. Use this year-end tax planning letter to get the conversations started with your small business tax clients to help them take a fresh look at their current and future financial health.

2021 Tax Planning Letter Simon Lever

2022 year-end tax letter.

. While we have seen some federal tax. Use this year-end tax planning letter to get the conversations started with your individual tax clients to help them take a fresh look at their current and future financial health. For your convenience the letter is divided into three sections.

As always please do not hesitate to contact us if you have any concerns or would like to learn. Dear Clients and Friends With the end of the year approaching it is a good time to review your 2019 income. This letter discusses some options available to help minimize your 2020 tax bill and.

TAX 2021 Year-End Tax Planning Letter for Individuals Lucy Luo CPA 22 November 2021 Time is ticking on year-end tax planning as 2021 draws to a close. Catch-up contributions of 6500 are allowed for. Regardless of uncertainty year-end tax planning opportunities should still be explored.

Year-end planning does not occur in a vacuum and is certainly impacted by the changing tax environment. Keeping all that in mind we have prepared the following 2018 Year-End Tax Letter. 2021 Year-End Tax Planning Letter Dear Clients and Friends.

2022 Last-Minute Year-End Medical Plan Strategies. 2022 Year End Tax Planning Letter for Business Clients As the year draws to a close its important that we meet to discuss any year-end strategies that might help lower your. You can contribute up to 20500 27000 if.

All small-business owners with one to 49 employees should have a medical plan for. In this letter our tax professionals offer a variety of. Tax Planning Insights Letter - Year-End Issue Promote your tax planning service to high-value clients Highlights year-end tax saving moves and encourages year-end planning appointments.

So far we have had to cope with a global pandemic extreme political division and a series of. The Tax Cuts and Jobs Act of 2017 TCJA substantially increased the standard deduction amounts thus making itemized deductions less attractive for many individuals. Individuals under 50 years old who work for an employer that has a 401 k plan can defer up to 20500 of income into that plan for 2022.

You must open it by December 31 although you have until April 18 2023 to contribute and take a tax deduction for 2022. What a year its been. Parker Tax Publishing November 1 2021 As Congress engages in intense negotiations over an ever.

It has been a challenging year both economically speaking and in terms of tax planning. Year-End Tax-Planning Moves for Businesses Business Owners Businesses should consider making expenditures that qualify for the business property expensing option. 2021 Year-End Tax Planning Guide For Individuals.

Download Our 2019 Year-End Tax Planning Letter. Download Our 2021 Year-End Tax Planning Letter November 16 2021 Dear Clients and Friends With the end of the year approaching it is a good time to review your 2021. As of the date of this letter the Infrastructure Investment and Jobs.

Key individual tax elements expiring in 2025 include the top tax rate for individual taxpayers reverting to 396 from 37 an end to the 20 section 199A qualified business. June 20 2022 We are excited to announce that the Abeles and Hoffman 2022 Mid-Year Tax Planning Letter is now available.

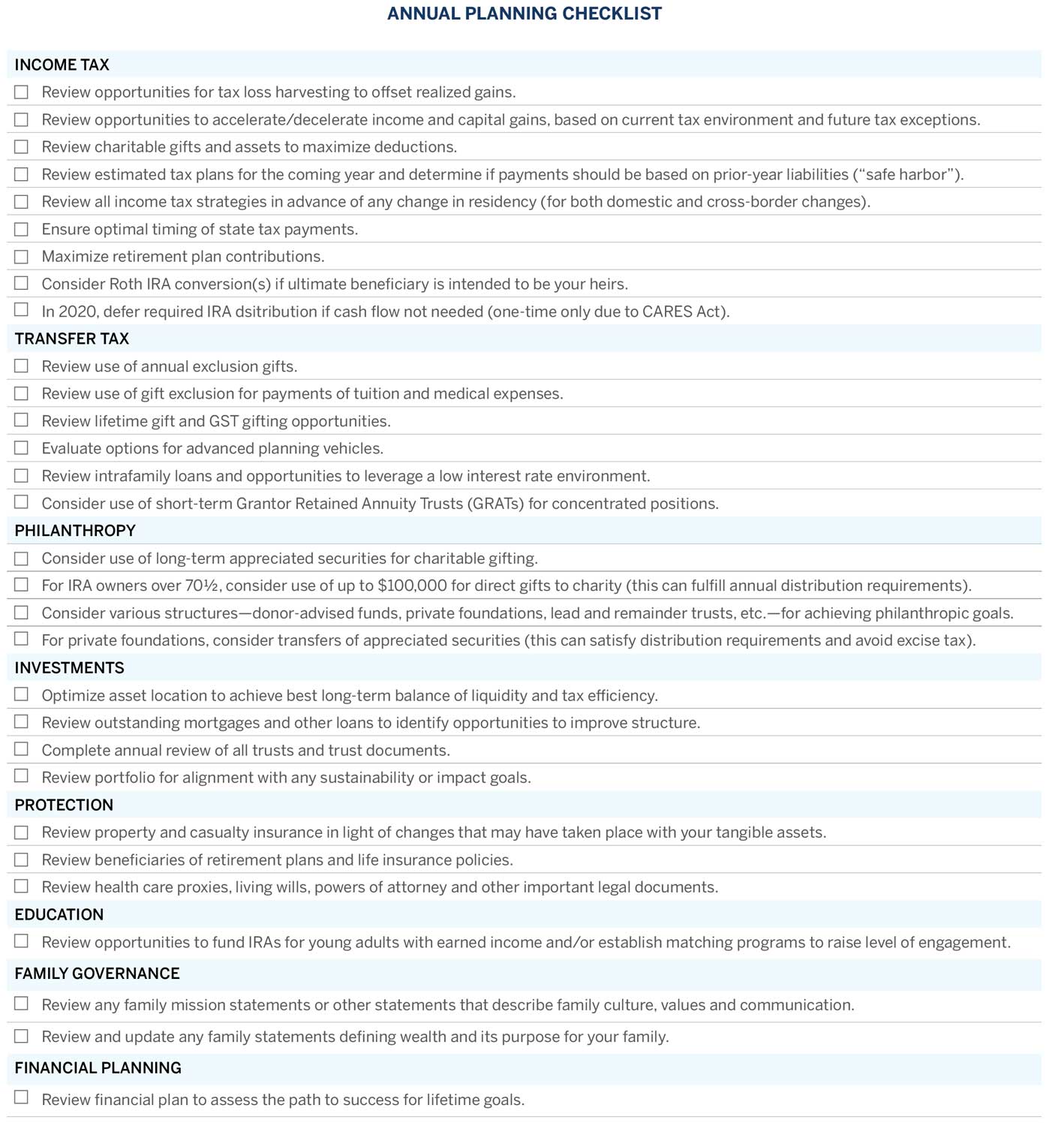

2020 Year End Planning Letter Brown Advisory

Small Business Tax Services Northern Va Small Business Accounting Services Dc Small Business Financial Services Northern Va Stitely Karstetter Cpas

2021 2022 Year End Tax Planning Letter Wise Tax Tax Preparation Services

Tax Planning Insights Letter Mid Year Issue Item 03 321

Download Our 2017 Year End Tax Planning Letter Whitinger Company

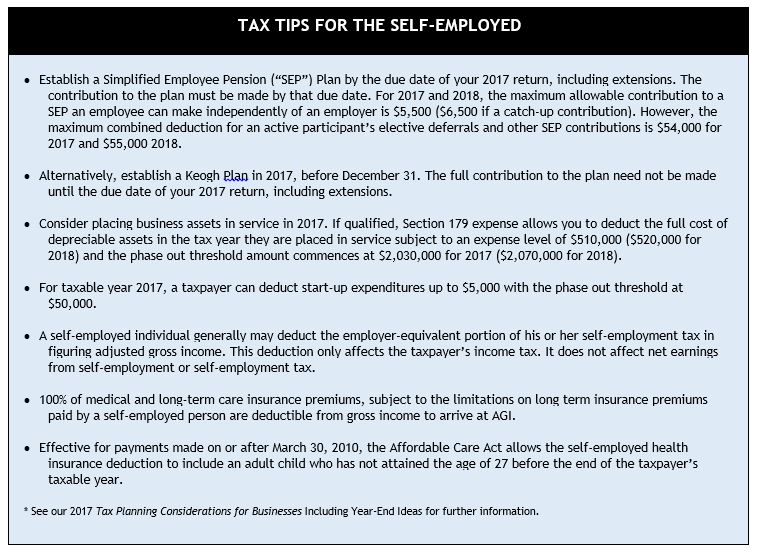

2017 Year End Tax Planning For Individuals Smith And Howard Cpa

2020 Year End Planning Letter Brown Advisory

2020 Tax Planning Letter Rfm Group

2020 Year End Tax Guide Tax Planning In Unprecedented Times Our Insights Plante Moran

4th Quarter 2015 Client Tax Letter Balsamo Stewart Lutters Ruth

2020 Year End Tax Planning State Local Taxes Bethesda Cpa Firm

Download Our 2021 Year End Tax Planning Letter Whitinger Company

Client Resources Wicks Emmett Cpa Firm

Year End Tax Planning Letter To Friends Clients Ronald K Jones Cpa Llc

2021 Year End Tax Letter Baker Tilly

Ahcpa Newsroom Tax Audit Advisory News